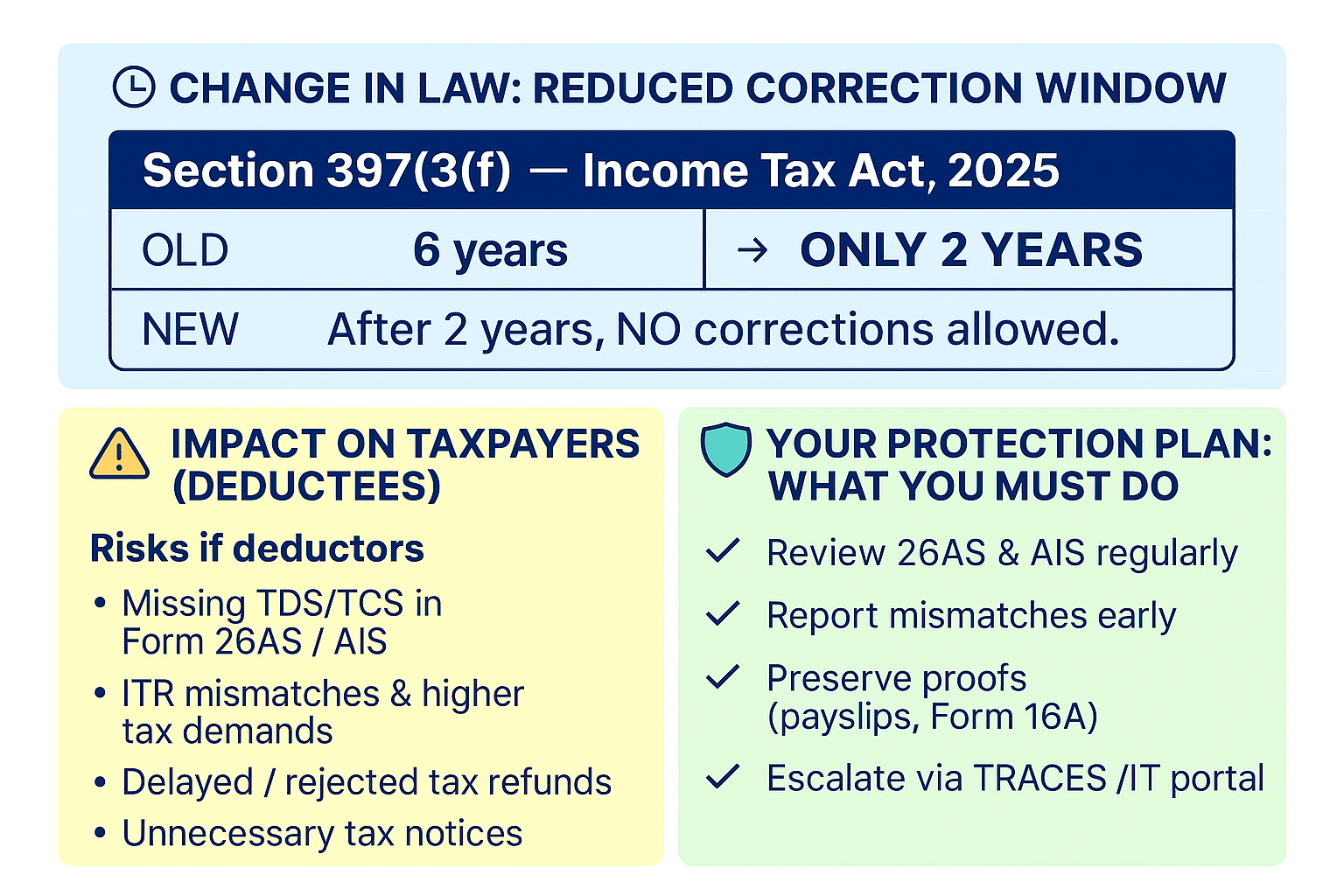

With Income Tax Act, 2025 getting effective from April 01, 2026, TDS compliance is going to change. There are changes in number of sections, clauses and timelines for compliance and corrections. With the amendment under Section 397(3)(f) of the Income Tax Act, 2025 – updated provision reduces the time limit to revise TDS return available to deductors to correct errors in TDS/TCS statements to just two years. After this period, no further corrections can be made. For all previous year data from 2018-19 onwards – all corrections must be done on or before Mar 31, 2026. Thereafter, all deductee tax credits will be lost and there will be severe penalties in case of any dispute.

This change makes timely reconciliation of Form 26AS/ Form 168 and the Annual Information Statement (AIS) more important than ever. While the law focuses on deductor responsibilities, the practical impact is borne primarily by taxpayers.

A Closer Look at the Change

TDS/TCS corrections are often required for routine issues such as incorrect PAN entries, mismatched challan details, incorrect deduction amounts, or missing entries. Earlier, deductors had more flexible timeline till 6 years; now the window is only two years.

How Errors Affect Taxpayers

1.Missing Tax Credit in Form 26AS/AIS – The deducted tax may not appear, despite being deducted.

2. Mismatch Issues During ITR Filing – Missing entries can trigger mismatch warnings or increased tax demands resulting into blocking of working capital for at least one year.

3. Delayed or Denied Refunds – Refunds may be delayed or rejected entirely

4. Unnecessary Notices & Scrutiny – Mismatches often trigger notices and clarification requests.

5. Stress & Inconvenience – Following up with deductors becomes time-consuming

Proactive Monitoring Is Essential

With the TDS return time limit for correction reduced, a proactive approach helps ensure that errors are detected early. https://taxreco.com/why-is-26as-reconciliation-not-a-year-end-activity/

What Taxpayers Must Do

– Review & Reconcile Form 26AS/ Form 168 & AIS regularly with your TDS Receivable ledger

– Report mismatches to deductors immediately by sending follow up emails.

– Preserve documentary proof such as payslips and Form 16A.

– Escalate non-resolved issues through TRACES or the Income Tax Portal.

TaxReco’s 26AS reconciliation automation can help you to proactively reconcile 26AS form with TDS Receivable ledger regularly. You can identify the entries against which deductor hasn’t deposited TDS with government. You can send follow up emails to deductors from TaxReco platform along with attached reconciliation report.